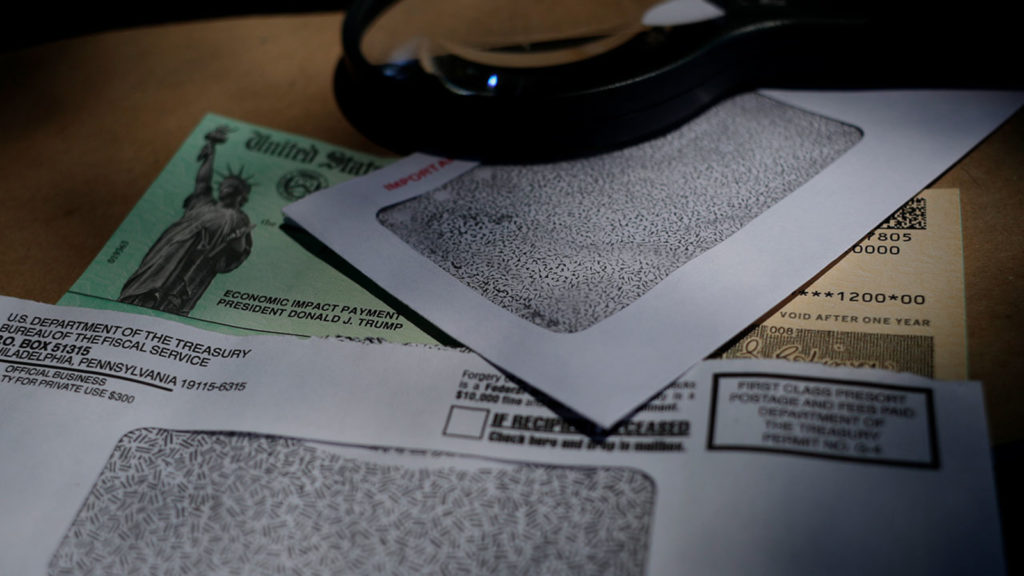

The Internal Revenue Service has already delivered over a hundred million third input checks. however if you’re still asking yourself “where’ my stimulus check,” the IRS has a web portal that helps you to track your payment. It’ is referred to as the “Get My Payment” tool, ANd it’ an updated version of the favored tool Americans accustomed track the standing of their first- and second-round stimulus checks. (To verify what quantity cash you may get, use our Third input Check Calculator.)

Note that you just can’t check the status of your first- or second-round stimulus payments with the updated tool. to search out the amounts of these payments, produce a web Internal Revenue Service account or talk to IRS Notices 1444 and 1444-B, that the IRS armored once first- and second-round input checks were issued. If you didn’t get an earlier payment, or your received not up to the complete amount, you may be able to get what you’re owed by claiming the Recovery Rebate credit on your 2020 tax come back. (You will file a return simply to say the credit although you aren’t needed to file.) Third-round stimulus payments aren’t accustomed calculate the 2020 Recovery Rebate credit, however they’re going to be used to figure the credit quantity on your 2021 tax return.

The updated “Get My Payment” tool more-or-less works a similar manner because the portal used for first- and second-round input checks. however here’ a course on what the tool does, what info you wish to provide, and what information the tool offers you. Check it out now therefore you recognize what to expect before coming into the portal on the IRS’ website.

What will the input Check Portal Do?

The updated “Get My Payment” tool lets you:

• Check the standing of your stimulus payment;

• make sure your payment sort (paper check or direct deposit); and

• Get a projected direct deposit or paper check delivery date (or verify if a payment hasn’t been scheduled).

For first-round input payments, you may conjointly use the portal to enter or amendment your checking account info to own your payment directly deposited into your account. However, that feature isn’t enclosed within the current tool (nor was it offered for second-round payments). The Internal Revenue Service already has bank account information for lots of Americans from recent tax returns, tax payments, the initial “Get My Payment” tool, the non-filers tool used last year, different federal agencies that often send profit payments (e.g., Social Security Administration, Railroad Retirement Board and Department of Veterans Affairs), and federal records of recent payments to or from the government. So, the tax agency is mostly limiting direct deposit payments to bank accounts that they have already got on file. As a result, you can’t amendment your bank info victimisation the “Get My Payment” tool. (And don’t decision the IRS, the person on the phone won’t be able to change your bank information, either.)

If your payment isn’t deposited directly into your bank account, then you’ll get either a paper check or a open-end credit within the mail (assuming you’re eligible for a payment). you may conjointly receive a payment by mail if your bank rejected an on the spot deposit. this might happen as a result of the bank info was incorrect or the checking account on file with the Internal Revenue Service has since been closed.

If a third-stimulus payment is armored to you, however the Post workplace is UNable to deliver it and returns it to the IRS, you’ll be able to use the “Get My Payment” tool to send the IRS your bank account information to own your payment reissued as an on the spot deposit. during this case, the portal can say “Need a lot of Information” regarding 2 to 3 weeks once the initial payment was issued. At this point, you’ll enter a routing and account range for your bank account, postpaid open-end credit or different monetary product that incorporates a routing and account number related to it. If you don’t give account info, your payment are reissued by mail when the Internal Revenue Service receives an updated address.

If you file a joint tax return, either spousal equivalent can usually access the portal by providing their own information for the safety queries accustomed verify a taxpayer’ identity. Once verified, a similar payment standing is shown for each spouses. In some cases, however, married couples who file a joint instrument could get their third input payment as 2 separate payments – half may return as an on the spot deposit and therefore the partner are armored to the address the Internal Revenue Service has on file. If that case, every spouse ought to check the “Get My Payment” tool severally victimisation their own Social Security range to ascertain the status of their payments.

If you submit info that doesn’t match the Internal Revenue Service’ records thrice at intervals a 24-hour period, you’ll be latched out of the portal for twenty-four hours (expect a “Please strive once more Later” message). You’ll even be locked out if you’ve already accessed the system 5 times within a 24-hour period. (The IRS is limiting every user’ daily access to manage system capacity.) Don’t contact the IRS if you’re shut out. Instead, simply wait 24 hours and take a look at again.

what is going to the standing Report Look Like?

For third-round input checks, the “Get My Payment” tool will show one amongst the following:

1. Payment Status. If you get this message, a payment has been issued. The standing page can show a payment date, payment technique (direct deposit or mail), and account info if paid by direct deposit. Note that “mail” means that either a paper check or a debit card. If you don’t acknowledge the checking account range displayed within the tool, it doesn’t essentially mean your deposit was created to the incorrect account or that there’ a fraud. If you don’t recognize the account number, it should be a problem relating to however information is displayed in the tool tied to temporary accounts used for refund loans/banking products.

2. would like a lot of Information. This message is displayed if your 2020 come back was processed however the Internal Revenue Service doesn’t have checking account info for you and your payment has not been issued yet. It might conjointly mean your payment was came to the IRS by the Post workplace as undeliverable. As mentioned above, if your payment is returned, you’ll have the chance to supply the IRS your bank account or open-end credit information in order that they will issue an on the spot deposit payment (click on the “Direct Deposit” button). If you don’t provide any account information, the IRS can’t reissue your payment till they receive AN updated address. (The quickest and simplest way to update your address with the Internal Revenue Service is to electronically file your 2020 instrument along with your current address.)

3. Payment standing Not Available. this implies either the IRS hasn’t processed your payment yet, the IRS doesn’t have enough info to issue you a payment, or or you’re not eligible for a payment. The IRS can still send third-round input payments to eligible Americans throughout 2021, therefore continue to check the portal for updates on your payment status.

The portal is updated no a lot of than once daily, usually overnight. As a result, there’ no reason to visualize the portal over once per day.

are you able to Use the Portal if You Didn’t File a Tax Return?

You mightn’t use the “Get My Payment” tool to trace the standing of your initial input check if you didn’t file a 2018 or 2019 federal revenue enhancement return. However, there was another on-line tool that non-filers could use to relinquish the Internal Revenue Service with the knowledge it required to method a payment.

The non-filers tool wasn’t used for second stimulus checks, though. Instead, if you didn’t file a 2019 tax return, and you didn’t use the non-filers tool to urge your first-round payment, then you have got to attend to say your second input check cash as a Recovery Rebate credit on your 2020 return.

The Internal Revenue Service isn’t victimisation the non-filers tool for third-round stimulus checks, either. As a result, if you don’t file a 2019 or 2020 tax return, you’ll got to claim any money you’re owed as a Recovery Rebate credit on your 2021 return, that you won’t file till next year. However, you’ll avoid having to wait until next year by filing a 2020 return before the could 17, 2021, deadline.

Note, however, that folks who receive Social Security, veterans, or different federal advantages who don’t typically file a instrument will use the “Get My Payment” tool to visualize their payment standing for his or her own payment once it’ been issued. Also, if you didn’t file a tax return, you receive federal benefits, and your benefits are presently deposited to a debit card, then your third input check are deposited thereto card. The bank info shown within the “Get My Payment” tool will be variety associated with your open-end credit and will be variety you don’t recognize.